The business also said it intended to switch to a cryptocurrency-only exchange while keeping a 1:1 ratio for client funds. On June 9, Binance.US declared that the Securities and Exchange Commission’s “extremely aggressive and intimidating tactics” had compelled them to act. With the new Binance Card, Brazil’s citizens can make purchases and pay their bills using crypto while benefiting from a real-time conversion system from 14 crypto assets to fiat at the point of sale.Join Our Telegram channel to stay up to date on breaking news coverageīinance.US has informed its customers of an impending halt to fiat (USD) withdrawal channels as early as June 13 and has announced the suspension of US dollar deposits. The company also partnered Mastercard to launch a new prepaid cryptocurrency card in Brazil in order to support crypto adoption in Latin America. This means that new customers can sign up to the newly regulated platform and get access to a range of products and services. Having received its licence as a Crypto Asset Service Provider / Category-4 (crypto-assets Exchange) on, the binance.bh platform allows Binance to provide a wide range of crypto-asset exchange services to customers. Binance has launched binance.bh, a regulated platform where users can access its portfolio of crypto products and services, including top ups and withdrawals in local currencies. So far in January 2023, Binance expanded its operations to Bahrain and partnered with Mastercard to launch a prepaid crypto card in Brazil. Binance revealed that no other banking partners are impacted and that Corporate Account clients will not be affected by this change. The service disruption will affect users with USD bank accounts that are looking to buy or sell cryptocurrencies for less than USD 100,000 via the SWIFT payment system. Binance has informed its retail customer base of this service disruption on 21 January 2023, and they also revealed that they are actively seeking a new SWIFT (USD) partner in order to avoid any service interruptions. In January 2023, Binance revealed that Signature Bank would no longer handle transactions of less than USD 100,000 for crypto exchange customers starting on 1 February 2023.

Signature Bank’s ban on bank transfers below USD 100,000

Furthermore, Binance officials revealed that only 0.01% of the company’s monthly active clients actually use USD bank transfers, but they also expressed their willingness to reboot the service as soon as possible.īinance US, which is regulated by the Treasury Department’s Financial Crimes Enforcement Network, will not be affected by the suspension, which means that only non-US clients who transfer money to or from bank accounts in dollars will be affected by Binance’s decision.Ĭustomers can still use other fiat currencies or payment methods to purchase crypto, and for the small number affected, Binance plans to reveal a new partner in the next few weeks and potentially look into restarting the service.

While the company has not issued an official explanation for the decision, we do know that the service will shut down on 8 February 2023 and that each affected customer will be notified individually.

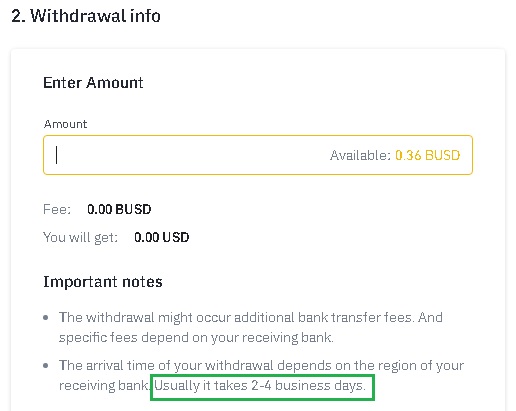

Cryptocurrency exchange Binance has announced that it will temporarily suspend deposits and withdrawals in US dollars.

0 kommentar(er)

0 kommentar(er)